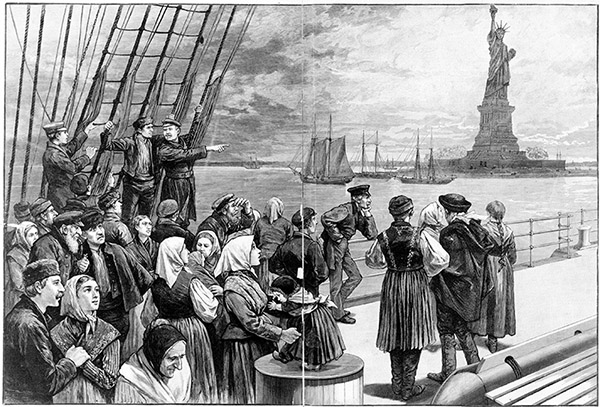

A Detailed Overview of EB5 Demands for Investors: Your Pathway to U.S. Residency

The EB5 Visa Program provides a structured avenue for international capitalists looking for united state residency. It calls for a considerable economic dedication targeted at work production for American workers. Potential capitalists should browse different eligibility standards and investment alternatives. Recognizing these demands is important for an effective application. Nevertheless, lots of intricacies can occur, triggering a more detailed assessment of the procedure and the challenges investors could come across.

Recognizing the EB5 Visa Program

While lots of capitalists seek pathways to irreversible residency in the USA, the EB5 Visa Program uses an one-of-a-kind chance for international nationals. Established by the Immigration Act of 1990, the program enables certified capitalists to obtain a united state environment-friendly card by making a substantial economic investment in a brand-new business enterprise. This financial investment should develop or protect at the very least 10 full time jobs for U.S. employees. The program intends to stimulate financial growth and produce employment possibility in targeted locations, particularly those with high joblessness prices or country areas. Financiers can choose to invest straight in their very own businesses or via marked Regional Centers that take care of financial investment tasks. The EB5 Visa Program is not simply an immigration path; it additionally acts as a means to promote development and development within the U.S. economic climate, bring in funding from around the globe while offering capitalists with a feasible route to permanent residency.

Qualification Requirements for Financiers

The qualification standards for investors in the EB5 visa program are crucial for determining engagement in this migration path. Trick aspects include particular investment amount demands, the authenticity of the resource of funds, and the kinds of services that get financial investment. Understanding these standards is crucial for prospective investors aiming to navigate the intricacies of the program.

Financial Investment Amount Demands

Financial investment quantity requirements function as an important limit for people seeking to join the EB5 Immigrant Capitalist Program. As of 2023, the minimal financial investment amount is evaluated $1 million in a brand-new business. Nevertheless, if the investment is made in a targeted work area (TEA), which is specified as a backwoods or one with high unemployment, the minimum requirement decreases to $800,000. These amounts are designed to stimulate financial growth and work development in the United States. Investors need to validate that their funds fulfill these limits to qualify, as failure to do so will certainly invalidate their application. Comprehending these investment amounts is vital for those thinking about the EB5 pathway to united state residency.

Resource of Funds

Figuring out the source of funds is a critical element of the EB5 Immigrant Investor Program, as it assures that the funding invested is legitimately acquired and fulfills program standards. Capitalists should provide thorough paperwork to develop the origin of their mutual fund, showing that they were obtained via lawful means. Acceptable resources can consist of individual cost savings, business revenues, or inheritance, to name a few. The United State Citizenship and Immigration Services (USCIS) calls for clear evidence, such as financial institution statements, income tax return, and lawful papers, to map the funds back to their initial resource. This comprehensive analysis ascertains that the investment adds to the U.S. economic climate and adhere to anti-money laundering regulations, thus guarding the integrity of the EB5 program.

Eligible Organization Types

Eligible business types under the EB5 Immigrant Financier Program play a crucial function in specifying the parameters for financier involvement. To qualify, a service has to be a new company or a struggling organization, with specific problems that have to be met. A new business is specified as one developed after November 29, 1990, or one that has actually been substantially rearranged or broadened. Distressed services have to have sustained an internet loss of at the very least 20% of business's web well worth over the last 2 years. Furthermore, the service needs to develop or maintain a minimum of 10 permanent work for certifying united state workers. Financiers need to additionally ensure that the service abide by all regional, state, and federal policies to maintain qualification.

Financial Investment Needs and Choices

As potential investors browse the EB-5 program, recognizing the certain financial investment demands and available options comes to be crucial. To get approved for U.S. residency, capitalists have to dedicate a minimum of $1 million to a new business, or $500,000 if the investment is made in a targeted work area (TEA), which generally includes backwoods or regions with high unemployment prices.

Financiers can pick to invest straight in a brand-new company or with a Regional Center, which pools funds from several capitalists to finance bigger tasks. Direct financial investments usually need energetic administration, while Regional Facility investments enable a much more easy function.

It is necessary for financiers to perform complete due diligence on prospective financial investment opportunities, making certain positioning with both individual financial goals and EB-5 needs. Understanding these choices can substantially impact the success of acquiring united state residency through the program.

The Application Process Explained

Navigating the application procedure for the EB-5 program calls for mindful attention to detail and adherence to particular steps - EB5 requirements for investors. Prospective investors must select a suitable investment project, usually with a regional center or direct investment. As soon as the financial investment is made, the following action includes putting together required documentation, including evidence of funds, individual identification, and the investment's economic influence analysis

After gathering the required documents, capitalists send Type I-526, Immigrant Petition by Alien Capitalist, to United State Citizenship and Migration Services (USCIS) This form must show that the investment meets all program needs, consisting of task creation and financial investment amount. Following USCIS authorization, financiers may use for conditional long-term residency through the entry of Type I-485 or consular processing.

Keeping Your EB5 Condition

Maintaining EB5 standing is crucial for financiers looking for to accomplish permanent residency in the United States. This includes adhering to certain conditions associated with their investment and making certain compliance with the laid out demands. Failing to satisfy these commitments can endanger a capitalist's residency status.

Problems of Permanent Residency

For EB5 financiers, the problems of long-term residency depend upon certain conformity requirements that need to be met to preserve their standing. Upon receiving a conditional permit, capitalists must stick to the specified financial investment and job development requireds. They must guarantee that their capital expense continues to be in danger and that the job creates a minimum of ten full time tasks for certifying united state employees. Investors are needed to submit an application to get rid of conditions within the two-year period following their preliminary residency authorization. This application should demonstrate that the investment has actually been maintained which the task production targets have been accomplished. Failure to conform with these problems can bring about the cancellation of permanent residency condition, emphasizing the significance of thorough oversight.

Conformity With Investment Demands

Conformity with the financial investment needs is vital for EB5 financiers to verify their proceeded irreversible review residency status. Financiers need click here for more info to allocate a minimum of $1 million, or $500,000 in targeted work areas, right into a certifying brand-new business. This financial investment has to create or maintain at least 10 permanent work for united state employees. Adherence to these criteria not only satisfies the problems establish forth by the united state Citizenship and Immigration Services (USCIS) yet likewise guarantees that capitalists keep their condition during the conditional residency duration. Routine tracking and reporting of the financial investment's progression are crucial. Failing to comply can bring about the abrogation of permanent residency, highlighting the importance of understanding and meeting these investment commitments to secure a course to united state residency.

Typical Obstacles and How to Get over Them

While directing via the EB5 investment process can be fulfilling, investors usually experience a number of usual difficulties that might prevent their development. One significant difficulty is the intricacy of the application procedure, which can be overwhelming without expert assistance (EB5 requirements for investors). Capitalists might additionally battle to determine legitimate EB5 jobs, as the market is rife with rip-offs and badly structured offerings. Financial documents postures an additional difficulty; making sure that funds are sourced lawfully and appropriately documented is vital for successful applications

To get rid of these challenges, financiers should involve knowledgeable migration attorneys and financial experts focusing on EB5. Performing complete due diligence on possible investments and looking for out credible local centers can alleviate threats associated with illegal projects. In addition, preserving organized and transparent monetary documents will enhance the documentation procedure, enhancing the possibility of authorization. By proactively dealing with these difficulties, capitalists can browse the EB5 landscape a lot more effectively and pursue their goal of united state residency.

Frequently Asked Questions

Can I Obtain EB5 While Living Outside the U.S.?

For how long Does the EB5 Investment Last?

The EB-5 financial investment usually lasts for a minimum of 5 years. After this duration, investors may get permanent residency, offered they meet particular task production and financial investment requirements established by the program.

Exist Age Boundary for EB5 Investors?

Can I Include My Parents in My EB5 Application?

Yes, an EB-5 investor can include their moms and dads in the application. Extra paperwork and eligibility requirements must be fulfilled to develop the connection and guarantee compliance with immigration guidelines throughout the procedure.

What Happens if My Investment Stops working?

If a financial investment fails, the investor threats shedding their resources and might not receive a return. This could threaten their qualification for U.S. residency, as satisfying the original source the financial investment requirement is vital for the EB-5 program.

Financial investment quantity demands offer as a crucial limit for people looking for to take part in the EB5 Immigrant Capitalist Program. Eligible organization kinds under the EB5 Immigrant Investor Program play an important function in defining the specifications for capitalist participation. Prospective investors need to choose an ideal investment task, generally through a local facility or straight financial investment. Compliance with the investment requirements is crucial for EB5 investors to confirm their proceeded irreversible residency standing. While guiding through the EB5 financial investment process can be gratifying, financiers commonly run into numerous common obstacles that may prevent their progress.